December is about throughput. January is about truth.

Peak trading does not suddenly create finance problems. It exposes the ones that were already there. When parcel volumes surge through Black Friday, Cyber Monday and Christmas, weak processes lose their tolerance for error. By early January, finance teams are left reconciling what really happened.

This guide is not about blame. It is about understanding where pressure reliably appears in parcel-based businesses and how to use January constructively rather than defensively.

Peak volume in context

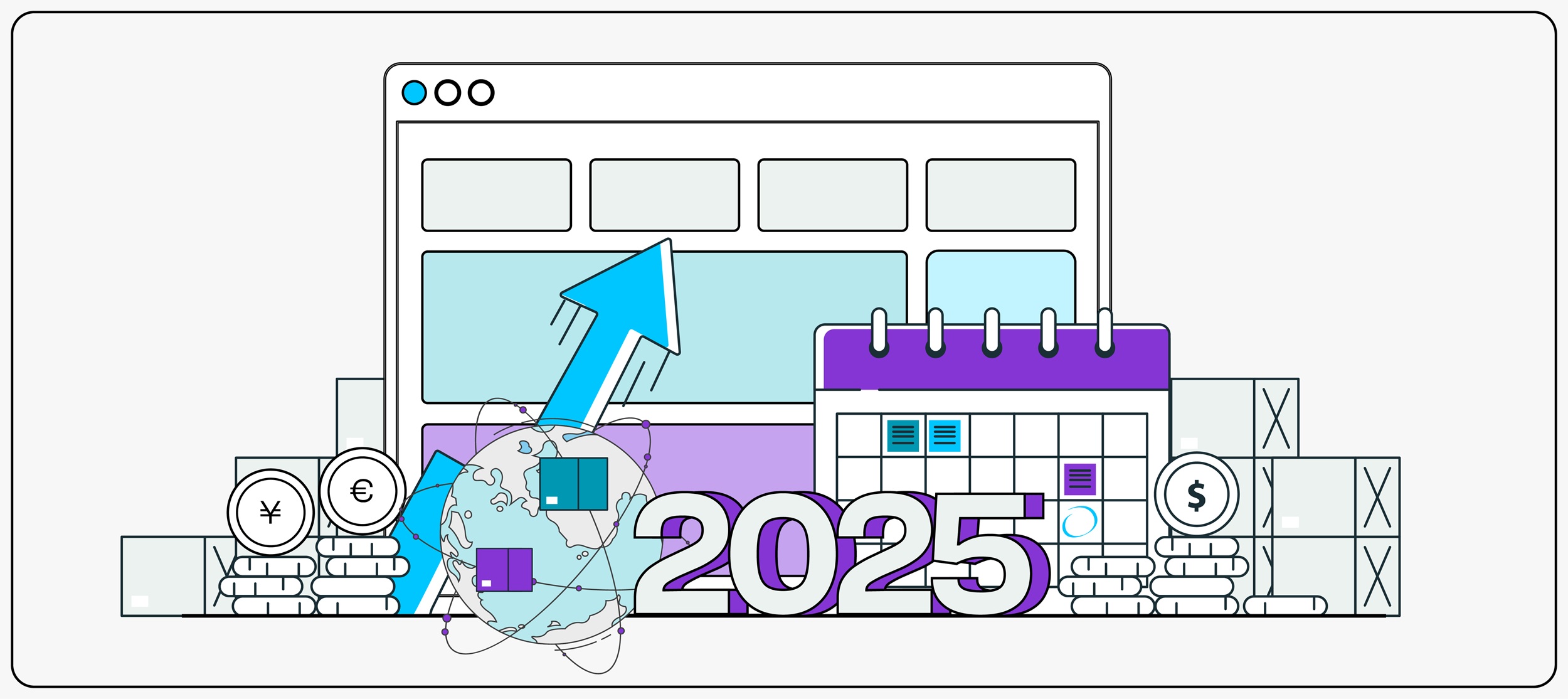

In 2025, UK online spending across the Black Friday to Cyber Monday weekend reached approximately £3.8 billion according to Adobe Analytics, reported by Reuters, now imagine what that looks like world-wide including cross border parcels!

More orders mean more consignments, surprise surcharges, more carrier invoices, and more billing events. For finance, that volume multiplies complexity long before it multiplies profit.

Where pressure shows up first

In parcel-centric operations, the same four areas feel the strain every year.

1. Accounts receivable slows down

A common failure mode looks like this. Duplicate consignments are billed under an outdated rate card. A residential or fuel surcharge is missed. The invoice goes out, the customer disputes it at month end, and payment is held. Multiply that by hundreds of parcels and days sales outstanding quietly slips by a week or more in January.

2. Accounts payable strains

Carrier invoices arrive late, fragmented, or with peak and fuel surcharges applied after the fact. Costs are recognised later than revenue, forcing finance to rely on estimates through December. By the second week of January, the true cost base lands, compressing the cash forecast and prompting an uncomfortable board discussion about why cash does not match December performance.

3. Accruals drift

Revenue is recognised when parcels ship. Costs, particularly variable surcharges, often arrive weeks later. Fuel or peak surcharges applied retrospectively mean December gross margin looks healthy in the initial pack, then needs to be restated once final carrier data is reconciled.

4. Reporting lags

Manual reconciliation across thousands of parcels extends close cycles. Management packs are delayed or revised. Confidence in the numbers weakens at exactly the point leadership wants clarity.

These issues are connected. A billing error becomes a dispute. A dispute delays cash. Late costs distort margin. Reporting becomes reactive rather than explanatory.

January is where it all converges

January is not just busy. It is revealing.

Customer payments, supplier invoices, accrual true-ups and returns all converge in the same window. Finance teams move from forecasting to explaining. If parcel-level cost and revenue visibility is delayed, January becomes fraught rather than informative.

The risk is not operational noise. It is loss of confidence in margin, cash position, and reporting accuracy.

What to focus on under pressure

Prioritise financial impact

Not every discrepancy matters. Focus first on issues that affect cash collection, margin integrity, and board credibility.

Be honest about manual limits

If December relied on extra hours and workarounds, the process is already failing at scale. Manual controls rarely break loudly. They fail quietly, in volume.

Treat January as a diagnostic

Ask where finance lacked visibility at parcel level. Where did estimates replace data. Where did timing, not performance, distort results.

Turning post-peak pressure into direction. Post-peak review is valuable if it leads to structural improvement.

- If disputes dominated January, invoice accuracy needs attention.

- If margins moved after the fact, cost recognition is too late.

- If reporting slipped, finance lacks a single, reliable view of parcel-level P&L.

Peak will return. Valentine’s Day promotions, spring sales, and mid-year peaks arrive quickly. The question is whether finance enters the next surge with clearer sight of cost and revenue as parcels move, not weeks later.

A focused next step

If January exposed pressure points in billing, accruals, or parcel-level visibility, GN TEQ offers a short diagnostic conversation to review where cost and revenue clarity breaks down under volume.

The aim is not a product demonstration. It is to assess how prepared your finance function is for the next peak in parcel volume and what would change that outcome.

Arrange a call with GN TEQ Today