Key Takeaways

You should attend if you are accountable for margin and growth in a logistics or e-commerce business operating across multiple carriers, regions, or currencies and want to understand how a CFO uses real-time parcel-level P&L to guide pricing, expansion, and investment decisions earlier in the cycle.

-

Parcel Economics

What Parcel P&L looks like in practice: by lane, service, customer, and region

-

Validated Data

Why cross-system validation is the foundation for accurate, decision-ready margin insight

-

Early Accruals

How forecasting supplier costs before invoices arrive sharpens accrual accuracy and cash visibility

-

Expansion Risk

Where real-time insight matters most when entering new markets or scaling cross-border

-

Finance Steering

The practical steps Skynet took to shift finance from reporting results to guiding decisions

Global Growth Fails Without Financial Visibility – Skynet Fixed That

Global expansion exposes the limits of after-the-fact reporting. Late supplier invoices, inconsistent regional data, and delayed accruals mean finance teams often see margin issues only after decisions are made.

As Skynet scaled across regions, this gap became clear. Growth outpaced financial visibility, leaving finance without timely insight into profitability by lane, service, and market.

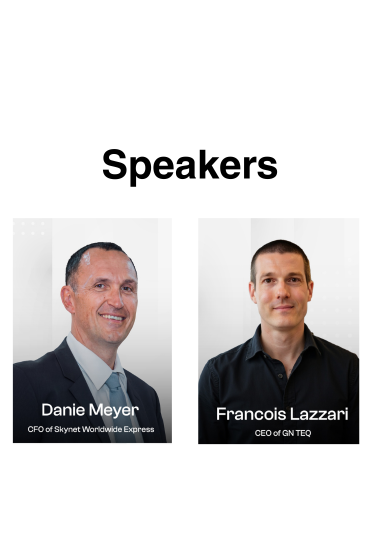

In this fireside chat, Skynet CFO Danie Meyer explains how moving to real-time, parcel-level P&L visibility changed how the business forecasts costs, detects margin pressure earlier, and supports cross-border expansion with stronger financial control.